2020 – 08/10 In an executive order, President Trump directed that Social Security and Medicare taxes be deferred from Sept. 1 through Dec. 31, 2020. There are still many questions that are unanswered about how this will work and there may be legal challenges. At this point, the taxes are just deferred, meaning they will still have to be paid. However, the order directs the U.S. Treasury Secretary “explore avenues, including legislation, to eliminate the obligation to pay the taxes.” The deferral will be made available for “any employee the amount of whose wages or compensation, as applicable, payable during any bi-weekly pay period generally is less than $4,000.” Stay tuned for more details.

Similar Posts

100% Bonus Depreciation

2020 – 09/23 The IRS has issued another set of final regulations on the additional first-year depreciation deduction, otherwise known as 100% bonus depreciation. The deduction generally applies to qualifying property acquired and placed into service after Sept. 27, 2017, and before Jan. 1, 2023. The final regs offer guidance on the requirements that must…

Contribution Deduction Limits

2021 – 10/05 If an employer has both a defined contribution retirement plan and a defined benefit retirement plan, what are the limits on contribution deductions? The IRS answered that question in an “Issue Snapshot.” Generally, an employer’s contributions to a qualified plan are deductible if they’re ordinary and necessary expenses and compensation for services…

Simple ways to make strategic planning a reality

2022 – 06/08 Every business wants to engage in strategic planning that will better position the company to sell more to current customers — and perhaps expand into new markets. Yet the term “strategic planning” is so broad. It’s easy to get overwhelmed by all the possible directions you could go in and have a…

How to handle evidence in a fraud investigation at your business

2022 – 09/21 Every business owner should establish strong policies, procedures and internal controls to prevent fraud. But don’t stop there. Also be prepared to act if indications arise that, despite your best efforts, wrongdoing has taken place at your company. How you handle the evidence obtained could determine whether you’ll be able to prove…

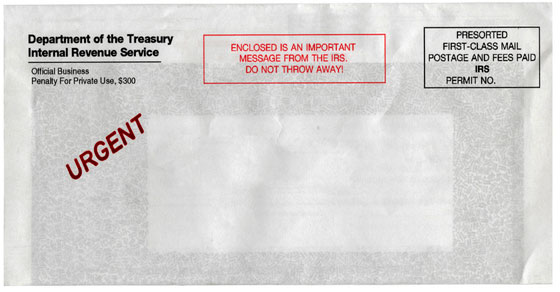

How the IRS Contacts Taxpayers

2022 – 04/11 During this busy tax season, the IRS is reminding individuals how it will and, more importantly, won’t contact taxpayers. If the IRS needs to contact you, typically it first delivers a letter through the mail. The agency may call after mailing a notice to confirm an appointment or to discuss an audit….

Affordable Care Act Update

2022 – 08/02 The Affordable Care Act’s (ACA’s) affordability percentage for employers to avoid a shared responsibility payment (penalty) is decreasing in 2023. The ACA’s employer-shared responsibility provision requires applicable large employers to offer minimum essential coverage that’s “affordable” and that provides “minimum value” to full-time employees or potentially make an employer-shared responsibility payment to…