2021 – 04/05 The IRS has provided guidance to employers claiming the employee retention credit (ERC) for 2021. In Notice 2021-23, the IRS explains how employers can determine their eligibility for, and the amount of, the ERC they may claim for the first two quarters of 2021. During the first two quarters of 2021, the ERC equals 70% of qualified wages that an eligible employer pays in a calendar quarter. The maximum amount of qualified wages an employer may use to calculate the ERC is $10,000 per employee. Thus, the maximum ERC is $7,000 per employee. The guidance also details the expanded categories of employers that may now be eligible to claim the ERC. Read Notice 2021-23 here:

Similar Posts

IRS additional guidance addresses COBRA assistance under ARPA

2021 – 08/18 In Notice 2021-46, the IRS recently issued additional guidance on the COBRA premium assistance provisions of the American Rescue Plan Act (ARPA). Under the ARPA, a 100% COBRA premium subsidy and additional COBRA enrollment rights are available to certain assistance eligible individuals (AEIs) during the period beginning on April 1, 2021, and…

IRS Fraud Detection

2022 08/17 Is the IRS successfully combatting business identity theft? The Treasury Inspector General for Tax Administration (TIGTA) recently took a look. In an audit, TIGTA reported that progress is being made by using filters to detect potential fraud, plus conducting prompt reviews of business tax returns with high-dollar refunds. However, it added: “TIGTA continues…

The Tax Implications of Owning a Corporate Aircraft

2021 – 12/06 If your business is successful and you do a lot of business travel, you may have considered buying a corporate aircraft. Of course, there are tax and non-tax implications for aircraft ownership. Let’s look at the basic tax rules. Business travel only In most cases, if your company buys a plane used…

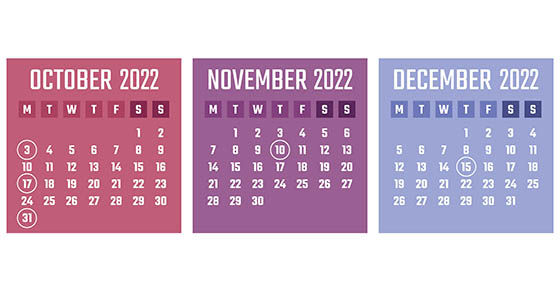

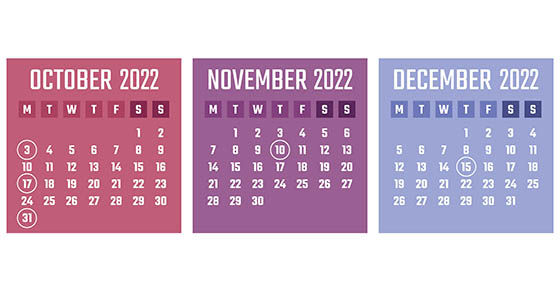

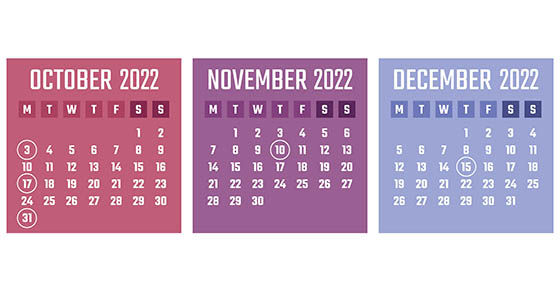

2022 Q4 tax calendar: Key deadlines for businesses and other employers

2022 – 09/19 Here are some of the key tax-related deadlines affecting businesses and other employers during the fourth quarter of 2022. Keep in mind that this list isn’t all-inclusive, so there may be additional deadlines that apply to you. Contact us to ensure you’re meeting all applicable deadlines and to learn more about the…

Keeping meticulous records is the key to tax deductions and painless IRS audits

2021 – 01/31 If you operate a business, or you’re starting a new one, you know you need to keep records of your income and expenses. Specifically, you should carefully record your expenses in order to claim all of the tax deductions to which you’re entitled. And you want to make sure you can defend…

Is an LLC the right choice for your small business?

2021 – 08/02 Perhaps you operate your small business as a sole proprietorship and want to form a limited liability company (LLC) to protect your assets. Or maybe you are launching a new business and want to know your options for setting it up. Here are the basics of operating as an LLC and why…

IRS additional guidance addresses COBRA assistance under ARPA

2021 – 08/18 In Notice 2021-46, the IRS recently issued additional guidance on the COBRA premium assistance provisions of the American Rescue Plan Act (ARPA). Under the ARPA, a 100% COBRA premium subsidy and additional COBRA enrollment rights are available to certain assistance eligible individuals (AEIs) during the period beginning on April 1, 2021, and…

IRS Fraud Detection

2022 08/17 Is the IRS successfully combatting business identity theft? The Treasury Inspector General for Tax Administration (TIGTA) recently took a look. In an audit, TIGTA reported that progress is being made by using filters to detect potential fraud, plus conducting prompt reviews of business tax returns with high-dollar refunds. However, it added: “TIGTA continues…

The Tax Implications of Owning a Corporate Aircraft

2021 – 12/06 If your business is successful and you do a lot of business travel, you may have considered buying a corporate aircraft. Of course, there are tax and non-tax implications for aircraft ownership. Let’s look at the basic tax rules. Business travel only In most cases, if your company buys a plane used…

2022 Q4 tax calendar: Key deadlines for businesses and other employers

2022 – 09/19 Here are some of the key tax-related deadlines affecting businesses and other employers during the fourth quarter of 2022. Keep in mind that this list isn’t all-inclusive, so there may be additional deadlines that apply to you. Contact us to ensure you’re meeting all applicable deadlines and to learn more about the…

Keeping meticulous records is the key to tax deductions and painless IRS audits

2021 – 01/31 If you operate a business, or you’re starting a new one, you know you need to keep records of your income and expenses. Specifically, you should carefully record your expenses in order to claim all of the tax deductions to which you’re entitled. And you want to make sure you can defend…

Is an LLC the right choice for your small business?

2021 – 08/02 Perhaps you operate your small business as a sole proprietorship and want to form a limited liability company (LLC) to protect your assets. Or maybe you are launching a new business and want to know your options for setting it up. Here are the basics of operating as an LLC and why…

IRS additional guidance addresses COBRA assistance under ARPA

2021 – 08/18 In Notice 2021-46, the IRS recently issued additional guidance on the COBRA premium assistance provisions of the American Rescue Plan Act (ARPA). Under the ARPA, a 100% COBRA premium subsidy and additional COBRA enrollment rights are available to certain assistance eligible individuals (AEIs) during the period beginning on April 1, 2021, and…

IRS Fraud Detection

2022 08/17 Is the IRS successfully combatting business identity theft? The Treasury Inspector General for Tax Administration (TIGTA) recently took a look. In an audit, TIGTA reported that progress is being made by using filters to detect potential fraud, plus conducting prompt reviews of business tax returns with high-dollar refunds. However, it added: “TIGTA continues…

The Tax Implications of Owning a Corporate Aircraft

2021 – 12/06 If your business is successful and you do a lot of business travel, you may have considered buying a corporate aircraft. Of course, there are tax and non-tax implications for aircraft ownership. Let’s look at the basic tax rules. Business travel only In most cases, if your company buys a plane used…

2022 Q4 tax calendar: Key deadlines for businesses and other employers

2022 – 09/19 Here are some of the key tax-related deadlines affecting businesses and other employers during the fourth quarter of 2022. Keep in mind that this list isn’t all-inclusive, so there may be additional deadlines that apply to you. Contact us to ensure you’re meeting all applicable deadlines and to learn more about the…

Keeping meticulous records is the key to tax deductions and painless IRS audits

2021 – 01/31 If you operate a business, or you’re starting a new one, you know you need to keep records of your income and expenses. Specifically, you should carefully record your expenses in order to claim all of the tax deductions to which you’re entitled. And you want to make sure you can defend…

Is an LLC the right choice for your small business?

2021 – 08/02 Perhaps you operate your small business as a sole proprietorship and want to form a limited liability company (LLC) to protect your assets. Or maybe you are launching a new business and want to know your options for setting it up. Here are the basics of operating as an LLC and why…