2021 – 08/06 Tax-related identity theft can happen if someone steals your personal information to commit tax fraud. As part of its “Boost Security Immunity” campaign, the IRS is promoting tighter security using effective tools such as multi-factor authentication. This allows a taxpayer to add another layer of protection. It can involve a security code sent to a mobile device, a personal ID number or a fingerprint, in addition to a username and password. Also recommended is the use of regularly updated anti-virus software. For more information about guarding your own identity:

Similar Posts

IRS Scam Alert

2022 – 03/02 With tax season well underway, the IRS warns taxpayers to remain on guard when it comes to security. Be especially mindful, says the IRS, of scams involving unemployment benefits. Many states have reported a surge in fraudulent unemployment claims filed using stolen identities. Unemployment benefits are taxable income and are reported to…

Like every business, a start-up needs a sensible budget

2022 – 11/16 An impressive 432,834 new business applications for tax identification numbers were submitted during October 2022, according to the U.S. Census Bureau. Indeed, despite the relatively higher costs of doing business these days, plenty of start-ups are still launching. One thing that every new company needs, along with a business plan, is a sensible…

DEI programs are good for business

2021 – 08/04 Many businesses are spending more time and resources on supporting the well-being of their employees. This includes recognizing and addressing issues related to diversity, equity and inclusion (DEI). A thoughtfully designed DEI program can do more than just head off potential conflicts and disruptions among coworkers; it can help you attract good…

Employee Retention Credit 2021

2021 – 01/27 The Employee Retention Credit (ERC) is extended for employers who keep workers on payroll. The recently enacted Consolidated Appropriations Act made several changes to the tax credit, which was created under the CARES Act. This includes modifying and extending it through June 30, 2021. For the first 2 quarters of 2021, eligible…

Get your piece of the depreciation pie now with a cost segregation study

2021 – 10/18 If your business is depreciating over a 30-year period the entire cost of constructing the building that houses your operation, you should consider a cost segregation study. It might allow you to accelerate depreciation deductions on certain items, thereby reducing taxes and boosting cash flow. And under current law, the potential benefits…

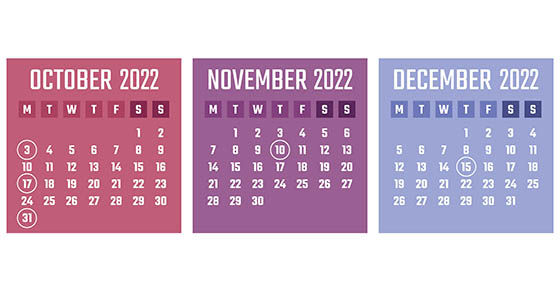

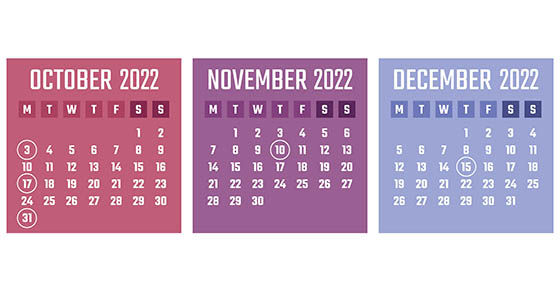

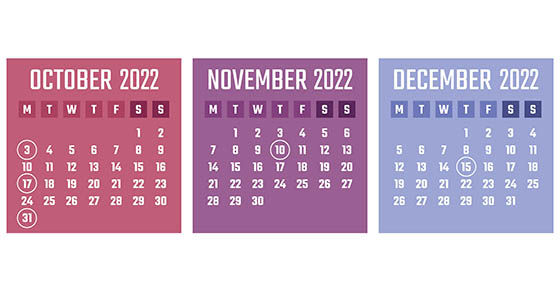

2022 Q4 tax calendar: Key deadlines for businesses and other employers

2022 – 09/19 Here are some of the key tax-related deadlines affecting businesses and other employers during the fourth quarter of 2022. Keep in mind that this list isn’t all-inclusive, so there may be additional deadlines that apply to you. Contact us to ensure you’re meeting all applicable deadlines and to learn more about the…

IRS Scam Alert

2022 – 03/02 With tax season well underway, the IRS warns taxpayers to remain on guard when it comes to security. Be especially mindful, says the IRS, of scams involving unemployment benefits. Many states have reported a surge in fraudulent unemployment claims filed using stolen identities. Unemployment benefits are taxable income and are reported to…

Like every business, a start-up needs a sensible budget

2022 – 11/16 An impressive 432,834 new business applications for tax identification numbers were submitted during October 2022, according to the U.S. Census Bureau. Indeed, despite the relatively higher costs of doing business these days, plenty of start-ups are still launching. One thing that every new company needs, along with a business plan, is a sensible…

DEI programs are good for business

2021 – 08/04 Many businesses are spending more time and resources on supporting the well-being of their employees. This includes recognizing and addressing issues related to diversity, equity and inclusion (DEI). A thoughtfully designed DEI program can do more than just head off potential conflicts and disruptions among coworkers; it can help you attract good…

Employee Retention Credit 2021

2021 – 01/27 The Employee Retention Credit (ERC) is extended for employers who keep workers on payroll. The recently enacted Consolidated Appropriations Act made several changes to the tax credit, which was created under the CARES Act. This includes modifying and extending it through June 30, 2021. For the first 2 quarters of 2021, eligible…

Get your piece of the depreciation pie now with a cost segregation study

2021 – 10/18 If your business is depreciating over a 30-year period the entire cost of constructing the building that houses your operation, you should consider a cost segregation study. It might allow you to accelerate depreciation deductions on certain items, thereby reducing taxes and boosting cash flow. And under current law, the potential benefits…

2022 Q4 tax calendar: Key deadlines for businesses and other employers

2022 – 09/19 Here are some of the key tax-related deadlines affecting businesses and other employers during the fourth quarter of 2022. Keep in mind that this list isn’t all-inclusive, so there may be additional deadlines that apply to you. Contact us to ensure you’re meeting all applicable deadlines and to learn more about the…

IRS Scam Alert

2022 – 03/02 With tax season well underway, the IRS warns taxpayers to remain on guard when it comes to security. Be especially mindful, says the IRS, of scams involving unemployment benefits. Many states have reported a surge in fraudulent unemployment claims filed using stolen identities. Unemployment benefits are taxable income and are reported to…

Like every business, a start-up needs a sensible budget

2022 – 11/16 An impressive 432,834 new business applications for tax identification numbers were submitted during October 2022, according to the U.S. Census Bureau. Indeed, despite the relatively higher costs of doing business these days, plenty of start-ups are still launching. One thing that every new company needs, along with a business plan, is a sensible…

DEI programs are good for business

2021 – 08/04 Many businesses are spending more time and resources on supporting the well-being of their employees. This includes recognizing and addressing issues related to diversity, equity and inclusion (DEI). A thoughtfully designed DEI program can do more than just head off potential conflicts and disruptions among coworkers; it can help you attract good…

Employee Retention Credit 2021

2021 – 01/27 The Employee Retention Credit (ERC) is extended for employers who keep workers on payroll. The recently enacted Consolidated Appropriations Act made several changes to the tax credit, which was created under the CARES Act. This includes modifying and extending it through June 30, 2021. For the first 2 quarters of 2021, eligible…

Get your piece of the depreciation pie now with a cost segregation study

2021 – 10/18 If your business is depreciating over a 30-year period the entire cost of constructing the building that houses your operation, you should consider a cost segregation study. It might allow you to accelerate depreciation deductions on certain items, thereby reducing taxes and boosting cash flow. And under current law, the potential benefits…

2022 Q4 tax calendar: Key deadlines for businesses and other employers

2022 – 09/19 Here are some of the key tax-related deadlines affecting businesses and other employers during the fourth quarter of 2022. Keep in mind that this list isn’t all-inclusive, so there may be additional deadlines that apply to you. Contact us to ensure you’re meeting all applicable deadlines and to learn more about the…