2020 – 12/07 The IRS is reminding employers that they must file Form W-2 and other wage statements by Feb. 1, 2021, to avoid penalties and help the IRS prevent fraud. A 2015 law made it a permanent requirement that employers file copies of Form W-2, “Wage and Tax Statements” and Form W-3, “Transmittal of Wage and Tax Statements” with the Social Security Administration by Jan. 31. That’s also the date Form W-2 is due to employees. This upcoming tax season, however, Jan. 31, 2021, falls on a Sunday, pushing the due dates to the next business day, which is Monday, Feb. 1. Form 1099-MISC, “Miscellaneous Income” and Form 1099-NEC, “Nonemployee Compensation” are also due to taxpayers on Feb. 1.

Similar Posts

Transferring College Savings Between Students

2021 – 09/21 by Deborah Carroll We ran into a dilemma in funding college for our children. Perhaps our experience will help you assess your own college spending options. We have two kids, each with a Texas Guaranteed Tuition Plan. Child 1 is done with school but has leftover hours in the plan, prepaid tuition…

IRS Notices

2022 – 03/28 As the IRS continues to work through a backlog of unprocessed returns, Congress and tax professionals have pressured it to stop sending delinquent return and collection notices. Many taxpayers receiving such notices have already filed tax returns but the IRS hasn’t processed them yet. On March 25, the IRS announced it will…

Form 5500 Revisions Proposed

2021 – 09/22 The IRS, the U.S. Department of Labor and the Pension Benefit Guaranty Corporation jointly announced a notice of proposed revisions to the Form 5500 Annual Return/Report filed for employee pension and welfare benefit plans. The proposals are intended to implement changes to the Form 5500 annual reporting under the SECURE Act, which…

Establish a tax-favored retirement plan

2022 – 03/14 If your business doesn’t already have a retirement plan, now might be a good time to take the plunge. Current retirement plan rules allow for significant tax-deductible contributions. For example, if you’re self-employed and set up a SEP-IRA, you can contribute up to 20% of your self-employment earnings, with a maximum contribution…

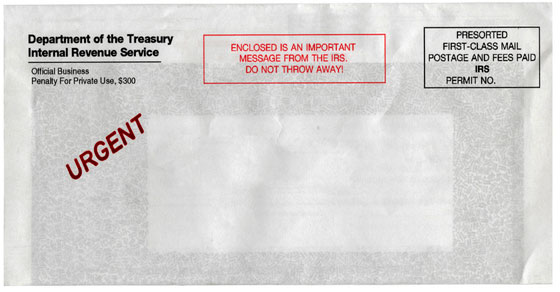

How the IRS Contacts Taxpayers

2022 – 04/11 During this busy tax season, the IRS is reminding individuals how it will and, more importantly, won’t contact taxpayers. If the IRS needs to contact you, typically it first delivers a letter through the mail. The agency may call after mailing a notice to confirm an appointment or to discuss an audit….

COVID-19 Assistance Package

2020 – 12/21 Congressional negotiators have reached an agreement on a COVID-19 assistance package. The $900 billion deal will provide a second round of direct payments and boost unemployment benefits. The direct payments will be up to $600 to individuals under a certain income threshold, and an additional $600 per child. Tax “extenders” are also…